BTC Price Prediction: Will It Reach $200,000 Amid Bullish Momentum?

#BTC

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

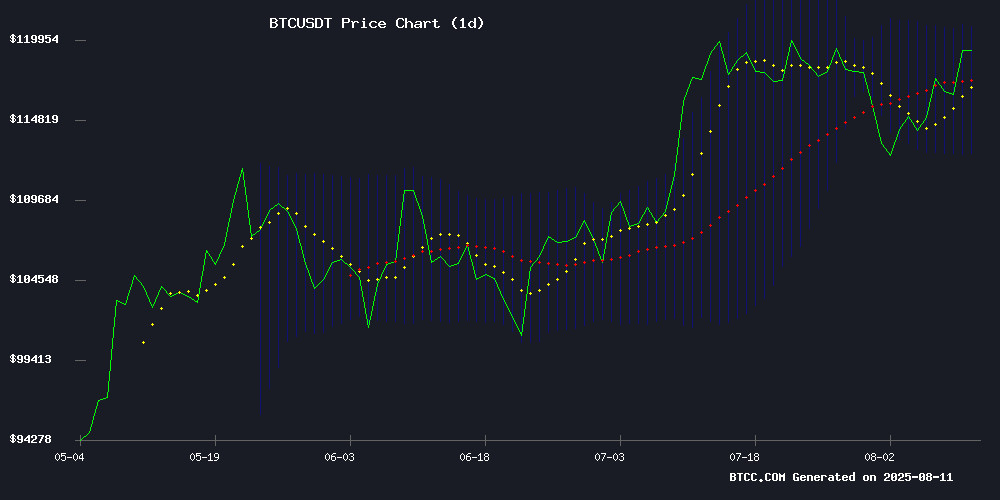

According to BTCC financial analyst John, BTC is currently trading at 119,301.98 USDT, above its 20-day moving average of 116,754.80, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 314.40, reinforcing upward momentum. Bollinger Bands suggest volatility, with the price NEAR the upper band at 120,842.60, signaling potential overbought conditions but also strong buyer interest.

Market Sentiment Boosted by Institutional Adoption and Regulatory Shifts

John from BTCC highlights that El Salvador's expansion of Bitcoin services for institutional investors and the surge in altcoin momentum are driving bullish sentiment. However, geopolitical uncertainty from Trump's policies and White House leadership changes may introduce volatility. The overall news flow supports the technical outlook, with institutional adoption (e.g., Harvard, U.S. retirement accounts) acting as a key catalyst.

Factors Influencing BTC’s Price

El Salvador Opens Doors for Investment Banks to Offer Bitcoin Services

El Salvador's Legislative Assembly has passed a landmark law permitting investment banks to handle Bitcoin transactions and digital asset services for high-net-worth clients. The move solidifies the country's push to become a regional hub for cryptocurrency innovation.

Under the new framework, qualified investment banks must maintain a minimum capital of $50 million. Services will be restricted to sophisticated investors holding at least $250,000 in liquid assets. The legislation enables banks to provide asset management, transaction structuring, and market analysis for digital assets.

This development follows El Salvador's 2021 adoption of Bitcoin as legal tender. Market observers see this as a strategic play to attract institutional capital and position the nation at the forefront of financial technology in Latin America.

Cryptocurrency Cloud Mining Emerges as Leveraged Investment Tool

Cloud mining platforms are reshaping cryptocurrency investment strategies by offering leveraged exposure to digital asset production. BTC Miner, a leading provider, enables participants to bypass traditional mining barriers through computing power leasing and AI-optimized operations.

The model applies technology leverage through centralized mining farms and capital leverage by allowing small-scale investors to access institutional-grade infrastructure. Returns are structured via principal-guaranteed contracts, contrasting with the volatile yields of direct crypto holdings.

This innovation mirrors historical leverage applications in real estate and equities, now adapted for the digital asset era. The platform's fixed-return approach appeals to risk-averse investors seeking cryptocurrency exposure without operational complexities.

CryptoAppsy Emerges as a Lightweight Solution for Real-Time Crypto Trading

CryptoAppsy positions itself as a nimble mobile tool for cryptocurrency traders, offering instantaneous market data without the friction of account creation. The app delivers real-time price tracking across thousands of assets—from Bitcoin to emerging altcoins—leveraging millisecond updates from global exchanges to identify arbitrage opportunities.

Portfolio management features allow manual input of holdings with instant valuation updates, while customizable alerts and curated news streams aim to reduce informational latency. The interface consolidates watchlists and historical charts in a single view, attempting to streamline the research process for active traders.

El Salvador Expands Bitcoin Access for Institutional Investors

El Salvador has enacted legislation enabling large financial institutions to offer Bitcoin and digital asset services to qualified investors. The new law requires institutions to hold at least $50 million in capital to operate as investment banks, with authorization to provide crypto-denominated services to clients possessing over $250,000 in liquid assets.

The regulatory framework builds upon existing crypto licensing structures, allowing traditional banks to expand into digital asset custody, token issuance, and crypto-linked financial products. Lawmaker Dania González emphasized the reform's role in modernizing El Salvador's financial infrastructure while maintaining regulatory oversight.

This move follows the nation's 2021 adoption of Bitcoin as legal tender, signaling continued commitment to cryptocurrency adoption. The Ministry of Economy's endorsement reflects strategic efforts to attract institutional capital into the country's digital asset ecosystem.

White House Crypto Council Director Bo Hines Resigns, Patrick Witt Likely Successor

Bo Hines, the executive director of the White House Crypto Council, has stepped down from his role after leading efforts to position the U.S. as a global leader in cryptocurrency innovation. Appointed in December 2024, Hines expressed gratitude for the crypto community's support and stated his intention to rejoin the private sector while remaining an advocate for the industry.

During his tenure, Hines worked closely with David Sacks, the AI & Crypto Czar, to shape U.S. crypto policy. His departure leaves a vacancy expected to be filled by deputy director Patrick Witt, who has been instrumental in advancing the council's objectives.

Hines was a proponent of budget-neutral strategies for Bitcoin accumulation, reflecting his bullish stance on digital assets. His resignation marks a pivotal moment for the council as it continues to navigate the evolving regulatory landscape.

Crypto Market Surges $400B in a Week as Altcoins Gain Momentum

The cryptocurrency market has staged a dramatic recovery, adding over $400 billion in value within just seven days. This resurgence follows weeks of subdued activity after the market retreated from its all-time high near $124,000. Institutional inflows and renewed retail participation have fueled the rebound, with traders now rotating into altcoins for higher potential returns.

Total market capitalization climbed from $3.6 trillion on August 3 to $4.02 trillion by August 10. While Bitcoin's rise toward $118,000 contributed to the gains, the market's return to peak levels suggests significant altcoin accumulation. ETF flows have been pivotal—after nearly $1 trillion in outflows during the correction, fresh capital is now driving liquidity back into the sector.

Early-stage projects and established altcoins are attracting attention as investors position for what could become a broad-based rally. The rapid capital rotation underscores growing risk appetite and a shift toward assets with higher beta to Bitcoin.

Trump’s Geopolitical Moves Stir Cryptocurrency Market Uncertainty

Bitcoin's price stability above $118,700 masks growing unease as former President Trump renews threats of secondary sanctions against Russia. The impending Alaska summit between Trump and Putin looms as a potential catalyst for market volatility, with failure to reach agreement risking disruptive economic measures.

China and India face particular exposure as major importers of Russian oil. Deputy Vance's warnings suggest escalating tensions, with China's chip export negotiations complicating the trade landscape. Market participants await clarity on whether threatened sanctions will materialize this week.

Harvard's Evolving Stance on Bitcoin: From Skepticism to Institutional Adoption

Harvard University's relationship with Bitcoin has undergone a remarkable transformation. In 2017, when BTC first breached $20,000, the cryptocurrency was met with skepticism from elite academic circles. Professor Kenneth Rogoff of Harvard famously predicted Bitcoin would collapse to $100 by 2028 rather than reach $100,000—a forecast that now appears strikingly off-mark as BTC trades above $118,000.

The institutional narrative has shifted dramatically. Where Harvard once represented academic skepticism, its endowment fund's reported Bitcoin investments signal a broader acceptance of digital assets. This reversal mirrors Bitcoin's journey from a speculative asset to a legitimate store of value, weathering bear markets that saw prices plummet to $3,200 in 2018 before achieving current six-figure valuations.

Market dynamics suggest this institutional embrace may accelerate. With Bitcoin's 2025 halving approaching, Harvard's participation underscores a growing recognition of crypto's staying power—a far cry from Rogoff's dire predictions. The Ivy League's evolving position reflects a broader trend: traditional finance increasingly views Bitcoin not as a passing fad, but as a fundamental component of modern portfolios.

Bitcoin Price Prediction Shifts as U.S. Retirement Accounts Gain Crypto Access

The landscape for Bitcoin investment has transformed with a historic policy shift allowing 401(k) holders to allocate retirement funds directly into cryptocurrency. This change, enacted under the Trump administration, marks a pivotal moment for institutional adoption—potentially stabilizing BTC's volatility through long-term capital commitments.

Analysts project trillions in U.S. retirement assets could now flow into digital currencies. Even a 1% allocation from 401(k) plans would inject tens of billions into Bitcoin, creating sustained demand pressure. Unlike speculative traders, retirement investors typically hold assets for decades, suggesting locked liquidity that may dampen price swings.

Market observers are revising BTC price targets upward as the "if" of institutional adoption becomes a "how much." The mechanics of retirement investing—dollar-cost averaging and buy-and-hold strategies—could fundamentally alter Bitcoin's market structure.

BlockchainFX, Blockdag, and Bitcoin Hyper Emerge as Top Crypto Presale Contenders

Crypto presales have evolved from niche fundraising mechanisms into high-potential investment opportunities, with early positioning often yielding exponential returns. Three projects—BlockchainFX ($BFX), Blockdag ($BDAG), and Bitcoin Hyper ($HYPER)—are currently dominating attention due to their strong fundamentals and scarcity-driven models.

BlockchainFX distinguishes itself as a unified trading platform combining features of Binance, Coinbase, and traditional brokerages. The live platform already processes millions in daily volume across 500+ assets, including crypto, forex, and equities, with robust security protocols and audited smart contracts.

While all three projects show promise for 2025 presale opportunities, BlockchainFX's operational maturity and multi-asset infrastructure position it as a standout candidate for investors seeking pre-exchange growth potential.

4 Best Crypto Cloud Mining Sites: Ultimate Guide 2025

Cloud mining has emerged as a viable alternative for individuals seeking to mine cryptocurrencies without the overhead of managing hardware. By leasing hash power from remote data centers, users can participate in Bitcoin and altcoin mining through specialized platforms.

The process eliminates upfront costs and technical barriers, allowing anyone to engage in mining by purchasing contracts from providers. These contracts grant access to shared computing resources, with profitability tied to the allocated hash power.

As adoption grows, cloud mining services are democratizing access to cryptocurrency generation. The model shifts maintenance burdens to professional operations while offering investors exposure to mining rewards through simplified interfaces.

Will BTC Price Hit 200000?

John at BTCC suggests that while BTC's technicals and news sentiment are strongly bullish, reaching $200,000 would require sustained institutional inflows and reduced geopolitical risks. Key data:

| Indicator | Value | Implication |

|---|---|---|

| Price vs. 20-day MA | +2.18% | Bullish |

| MACD Histogram | 314.40 | Upward Momentum |

| Bollinger %B | ~0.9 | Near Overbought |

- Technical Strength: BTC trades above key moving averages with bullish MACD.

- Institutional Demand: El Salvador and U.S. retirement accounts fuel adoption.

- Geopolitical Risks: Trump-related uncertainty could temper gains.